The #1 Resource for CPA Review

Pass the CPA Exam with UWorld CPA Review, the only CPA test prep that includes top accounting instructors like Roger Philipp (CGMA, CPA) and Peter Olinto (CFA, JD, CPA inactive). With the industry’s highest pass rate, you can feel confident you’ll have everything you need to pass.

We're proud to announce our acquisition of Wiley Efficient Learning's test-prep portfolio and welcome Wiley’s team of accredited accounting professors, including Peter Olinto (CFA, JD, CPA inactive) to UWorld CPA Review. This strategic addition strengthens our CPA review by combining our proven learning methodologies with Wiley's product excellence.

Why Choose UWorld CPA Review?

Helping over

prepare for high-stakes exams

Proven results with a

Rate

on the CPA Exam

Pass in

with SmartPath Technology™

Become a Partner for CPA & Accounting Education

We partner with hundreds of educational institutions, employers, and professional organizations to provide leading CPA review material and accounting resources.

Game-Changing CPA Exam Review

We’ve changed how candidates prepare for the CPA Exam. With our award-winning CPA prep, you’ll master difficult accounting topics on a deeper level. We help you truly understand the material for improved performance on the CPA Exam and in your career.

Understand Difficult Accounting Concepts with Visual Learning

High-quality questions and detailed answer explanations – written by practicing CPAs and accounting educators – include vivid illustrations, diagrams, flowcharts, and tables that provide immediate feedback and bring tough CPA Exam topics to life.

CPA Study Tools for Every Student

Learn more about the innovative product features you can benefit from when you choose our trusted CPA review. Designed by CPAs for aspiring CPAs.

Study Smart and Pass Faster with Time-Saving Technology

UWorld is recognized as a leader in education technology. With innovative and adaptive tools that improve learning outcomes, we help you study difficult concepts efficiently, retain more information, and ultimately know when you are “exam ready.”

What Our Students Think About UWorld CPA Review

UWorld CPA Review is an amazing review course. The lectures are relevant and engaging. Watch the lectures, do the questions at least twice, and use flashcards. Stay strong, don’t give up, and you can pass!"

___Lauren W.

SmartPath is an absolute game changer. I had an 18-month (toddler) at home and my wife was expecting, and I passed all four parts in months while introducing the world to my second baby girl three days before one of my exams.”

___David R.

The QBank is well organized, very thorough, and prepared me for the CPA Exam. The question modules (and accompanying performance trackers) were the most valuable tools I had when preparing for the exam! I highly recommend UWorld!”

___Jennifer N.

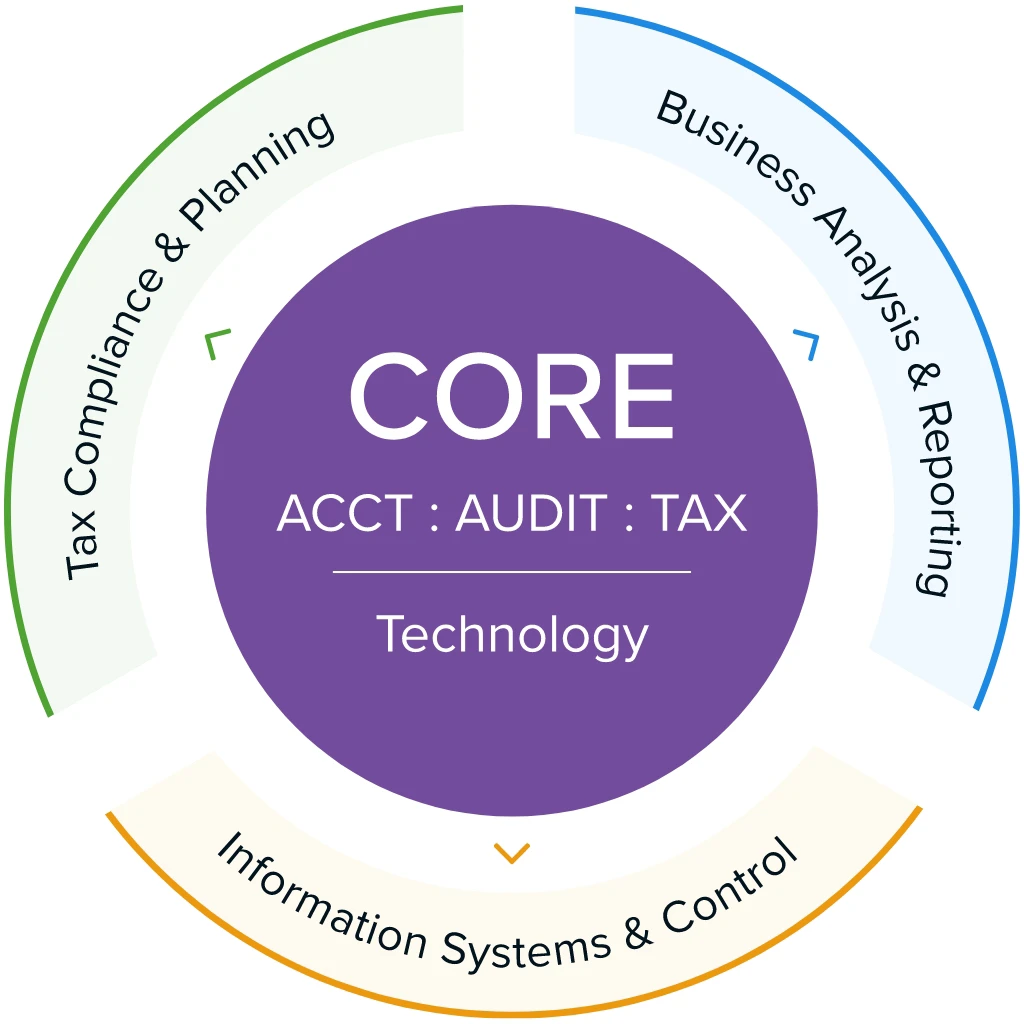

Prepare for the

2024 CPA Exam Evolution

Are you ready? We are! Our experts are working around the clock to prepare for the 2024 CPA Evolution. It’s our top priority to bring you the highest-quality content and most effective 2024 CPA review program.

Take a Fresh Start

Not Satisfied

with Your CPA Test Prep?

We’re here to help! If you’ve purchased another CPA review program and are not satisfied with your results, you may qualify for a FreshStart Discount.

Award-Winning Leader in Education Technology

19th Annual American

Business Awards®

Elijah Watts Sells Award

Student Winner

GSV Global EdTech

50 Member

EY Entrepreneur of the Year®

- Southwest

Frequently Asked Questions

What is a CPA review?

Is Wiley CPA part of UWorld CPA Review?

Can I pass the CPA Exam just by using UWorld CPA Review?

Is UWorld CPA Review regularly updated for CPA Exam changes?

How to use UWorld CPA Review?

- Log in to your UWorld course

- Download our CPA app for Apple and Android to study from anywhere

- Get started by viewing Roger CPA lectures or reading from your textbook

- Practice with our award-winning CPA question bank

- Remediate weaknesses through digital flashcards and My Notebook

- Track your progress with SmartPath Predictive Technology™